The Local Government: Municipal Property Rates Act, 6 of 2004, as amended, stipulates the compilation of municipal valuation of properties and the purpose thereof to determine rates for individual properties as well as the overall rate value calculations for the city.

The General Valuation Roll is a document containing the municipal valuations of all the registered properties within the boundaries of the Greater Bitou municipal area. It is used to calculate the rates that property owners are required to pay.

The General Valuation Roll gives the market value of a property on a certain date. It applies to residential, agricultural, business, and commercial properties. It is used to calculate the monthly rates that property owners are required to pay for services such as street lighting, parks, libraries, fire services, etc.

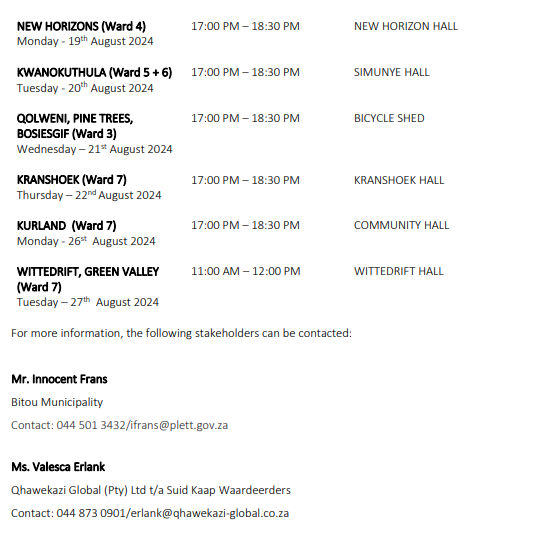

The Bitou Municipality has appointed a service provider, Qhawekazi Global (Pty) Ltd t/a Suid Kaap Waardeerders.

The process to compile the General Valuation Roll of an estimated 20,000 properties in the Greater Bitou area, must be completed and physical inspections of properties must be done. The final General Valuation Roll will be published for public inspection when completed. At the same time, stakeholders will be given the opportunity to lodge objections, if deemed necessary.

The objection process is followed by a valuation appeal process. The General Valuation Roll will be implemented on 1 July 2025.

Ratepayers must verify their valuations, as it would affect the rates they pay on their own properties as well as the overall rate calculations for the city. It is a great opportunity for citizens to engage with the Municipality to ensure that their properties are correctly valued.

What is a valid objection?

There are various reasons that allow owners (or their authorized representatives) to submit an objection against a specific property on the Municipality’s General Valuation Roll. According to the Municipal Property Rates Act (MPRA) Section 50 (1)(c) an objection with the municipal manager against any matter reflected in, or omitted from, the roll can be lodged against a single/specific property (Section 50 (2) (1) c of the MPRA).

Legitimate reasons for lodging an objection include: Town Allotment • Suburb • Sectional Title Scheme Name • Erf No • Portion • Section • Unit • Owner Name • Category • Physical Address • Extent • Market Value • Omitted • Farm Name.

What are non-valid reasons/objections and will not be considered: No Services • I am a pensioner (refer to rates policy regarding rebaits) • My rates are too high (refer to rates policy for cent in the rand) • Comparing to similar properties in the valuation roll (objection must be lodged against the property with the incorrect value and using market sales for comparison) • Comparing current value with previous valuation • Various erven on one objection form, (every erf must have own objection form).